Just what are Mobile Costs? And the ways to Use casino so much sushi them

Basic, sign up for the newest credit before you could take a trip and you can down load the relevant software you to goes with casino so much sushi it. Import money from the lender so you can best-within the credit balance in your home currency then move one to to your Korean obtained (or any other currencies you will need). Once you arrive in Korea, use the card as you manage a consistent mastercard.

pieces of economic advice all the basic-age group American demands: casino so much sushi

Making use of your mobile phone so you can faucet and you can pay during the checkout will likely be a quick and simple solution to buy things rather than swiping an excellent charge card if you don’t getting the real wallet on you. As well as, once you here are a few along with your cellular phone, their actual cards matter is not mutual, permitting deals which is often safer than swiping or inserting your own credit to your a charge card viewer. To invest together with your cellular phone using your Funding One to credit or debit credit, simply proceed with the tips so you can link your own credit for the electronic purse. Following, set your Financing One to cards as your popular percentage method. Linking their Funding You to definitely cards is an excellent way to be sure you continue to earn benefits for the requests made out of the mobile phone.

See your nearby store

- Pay-by-cellular phone alternatives are extremely easy and comfy to use.

- If you don’t, you can visit the new software shop in order to down load the new bag served by your cellular phone’s operating system.

- You could potentially money it purse and possess rating money delivered to you from the other people that have Fruit Spend.

- Some individuals prefer having fun with dollars more cards as they believe it can be aware of their using.

- Should your statement equilibrium try lower than $27, the mark Credit card minimal percentage might possibly be comparable to the new equilibrium.

A payment service provider things an online card complete with a great novel card matter and security password. Utilizing your cell phone bill entails the brand new payment was produced later. A cellular viewer try an item of tools which allows you in order to safely and you will easily accept bank card transactions on your cellular telephone. Sometimes they both plug in the equipment in person or due to a great Wireless union.

There are a few solid alternatives if you’re looking for the best mobile fee apps, while the observed by possibilities i’ve within this guide. We have picked out everything we imagine is the newest good the fresh heap, regarding quality and performance. Having for example independence in the getting together with the credit cards viewer, Samsung Pay is it really is exchange you to definitely heap from playing cards inside the your own bag with a phone app. Some other possible advantageous asset of contactless cell phone money is they can be getting safe. Since the percentage info is stored to your cellular telephone and sent wirelessly on the fee critical through NFC technical, there’s shorter value somebody stealing a physical cards or bucks. The country is evolving all around us, and thus ‘s the means we pay for products or services.

Set the fresh standard card to have costs

- There is the situation from a dead battery—more i trust technology, the greater amount of powerless our company is whether it fails.

- And make a cost, electronic purses make use of your cellular phone’s cordless functions along with Wi-Fi, Wireless and you will magnetic signals.

- Simply click the brand new Set up Auto Renew switch on the website or click the Automobile Renewal tab after you create a payment to your software.

- When you get your Square mobile money reader, it’s super-easy to start accepting Apple Pay and Google Shell out instantly.

- You can around a dozen cards to the Fruit Shell out account, with only on the all the lender in the us now offered.

Debit notes try a step above money in terms of defense, but are however a relatively risky fee means. Debit cards you may leave you liable for fund destroyed to scam, offer crooks immediate access on the bank accounts, introduce you to overdraft charge and you will exposure tying your money in the hold fees. Samsung Wallet uses NFC (Near Career Communication) technical so you can transfer cards information to the NFC-permitted (faucet and you can spend) percentage critical. Rather than scraping their debit otherwise bank card, secure the cellular telephone near the critical to accomplish commission. Which have Wallet, you may also access QR requirements to help you see boarding tickets, the medical information, and.

As to why cannot I prefer to expend from the cellular telephone to own distributions?

Find Guide 525, Taxable and you can Nontaxable Income, to own information. Taxpayers in these parts actually have up until Will get step 1, 2025, to help you document various government private and company tax statements and make income tax repayments. To create it, start with to purchase a prepaid credit card that’s compatible with Apple Pay. Stick to this step-by-step self-help guide to playing with credit cards … without the cards. To make use of faucet to invest for the Pixel Flex or another foldable device, bend their device. Credit cards and you may banking professional Jenn Underwood provides more than 16 many years of private finance feel to the table.

You’ll find numerous implies enterprises is undertake credit card money to your a telephone––yet not all of the cellular commission models are affordable and you may safe. Check out this help guide to learn about the best mobile section out of selling possibilities. Once you get your own Rectangular mobile payments audience, it’s awesome-very easy to start taking Fruit Pay and you may Bing Spend instantly.

Pursuing the fee is distributed, your own individual are certain to get an email notification. If the individual doesn’t have an excellent PayPal account, we’ll establish ideas on how to create you to definitely. The fresh PayPal professionals need show the email and you will over one required term verification before they’re able to accept the percentage. If you are PayPal are a greatest possibilities, it will not render airtight protection.

Financial from America features

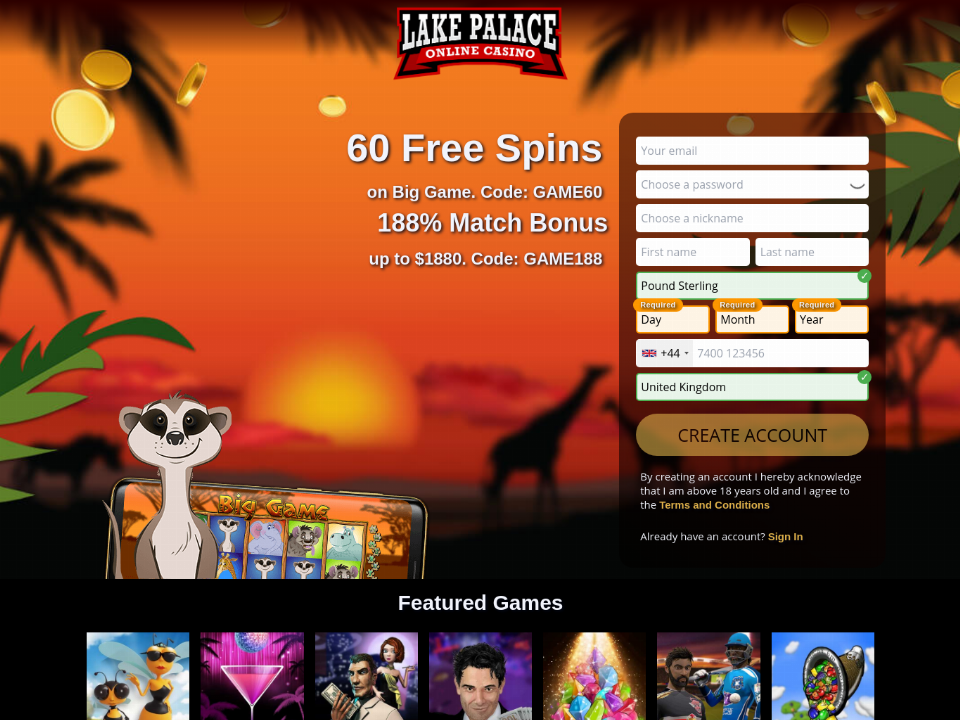

When the immediate access are enabled, swipe right up from the bottom of your own display screen in order to discharge the newest application and you may support the cell phone close to an NFC-enabled terminal to do payment. Wallet lets you include scientific suggestions, features resource administration, and the capacity to include boarding passes, electronic car secrets, and you may electronic family important factors. It’s a gambling establishment that allows one make dumps playing with their phone number. Of many Southern area Africa online casinos based in the European union/United kingdom get this commission solution. The new deposit might possibly be paid instantly plus the amount of money was put in your own portable bill.

Desktop & Cellular

Minimal payment ‘s the smallest amount you’re obligated to shell out from the… Once you build your commission, it will be possible so you can identify the amount we would like to pay – a complete equilibrium otherwise any count you to definitely’s no less than the minimum due. You will need establish the fresh go out you would like the fresh fee as produced.

To make an installment, electronic wallets make use of your mobile phone’s wireless services as well as Wi-Fi, Wireless and you will magnetized indicators. The brand new magnetic signals link thanks to anything entitled Near community communication (NFC). These types of indicators broadcast their credit otherwise debit card suggestions out of your mobile phone to help you an instrument the retailer will bring, that’s made to discover this research. The newest Android mobile commission application are Bing Pay that comes preloaded to the Android os cellphones. It’s recognized at the of many shops, along with Bloomingdale’s, Chick-Fil-An excellent, KFC, Nike and you will Staples, and now have online features such as Airbnb and you will DoorDash.